Lead the charge in modern trade finance

A trade finance experience you and your clients will love

In today's fast‑paced global economy, trade finance plays a pivotal role in facilitating international trade transactions. Finzly provides a seamless back office automation and an intuitive trade experience that delights both you and your clients.

Offer a truly integrated transaction banking experience for your clients

Seamless FX trading

Provide your clients with real‑time market insights and the ability to execute FX trades directly within the platform, without the need to navigate between multiple systems.

Integrated trade finance

Enable your clients to streamline the management of letters of credit, documentary collections, and other trade finance products alongside their payment activities.

Centralized payments

Equip your clients to initiate, track, and reconcile all their domestic and cross‑border payments from one convenient location.

Enhanced visibility

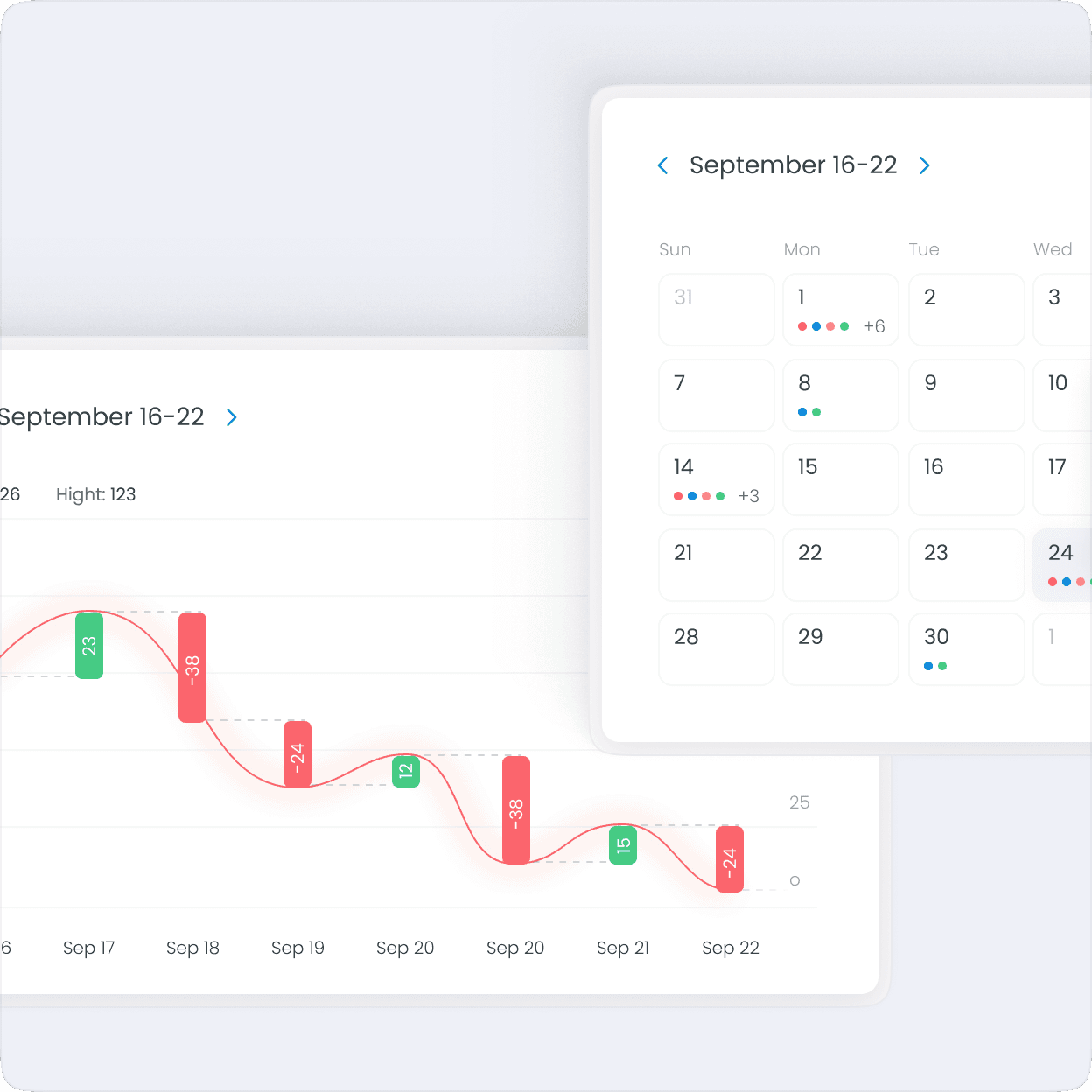

Deliver your clients complete transparency into their global transactions, with a unified view of their FX positions, trade finance activities, and payment flows.

Benefits you can bank on

Enhanced operational efficiency

The solution streamlines cross‑functional workflows and eliminates data silos, automating manual processes and reducing errors through integrated workflows. It also leverages a single technology stack to minimize maintenance and upgrade costs.

Increased revenue opportunities

The solution allows banks to cross‑sell complementary products and services, expanding the scope of banking services offered to clients and helping banks capture a larger share of their clients' global transaction volumes.

Improved risk management

The solution provides real‑time visibility into clients' FX positions, trade finance activities, and payment flows, enabling proactive monitoring and management of credit, liquidity, and operational risks. It also ensures compliance with regulations through centralized controls and audit trails.

Competitive advantage

The solution differentiates the bank's offering in a crowded market, positioning the bank as a trusted partner for global transaction banking and helping to attract and retain high‑value corporate and commercial clients through outstanding transaction banking experience.

Regulatory compliance

Cutting‑edge screening tools to ensure regulatory compliance across all processes.

Discrepancy management

Simplify management with seamless electronic processing, approval, and audit trail.

Payment processing

Efficiently manage payments, discounts, and settlements throughout the payment cycle.

Comprehensive accounting

GAAP/IFRS‑compliant accounting for proprietary trading and comprehensive reporting.

Automated End of Day (EOD)

Streamline postings, fee amortization, revaluation, statements, and custom jobs with automated EOD processing.

Document management

Manage templates for diverse customers to create, review, and approve documents.

Trade, pay, manage – all in one place: the pinnacle of transaction banking experience

Simplify global transactions for your corporate clients through a unified transaction banking experience. Enable them to seamlessly manage foreign exchange, trade finance, and payments – all within a single intuitive platform.

Insights

American Banker Webinar On Demand: What Bankers Really Think About Stablecoins – And Why It Matters Now

Synovus Expands International Trade Finance with Finzly

PCBB and Finzly Partnership Boosts International Payment Services

Growth strategies in foreign exchange: Synovus, First Citizens share their experience

Webinar On Demand – Growth strategies in Foreign Exchange: Synovus, First Citizens share their experience