Smart ISO 20022 compliance

Futureproof your ISO 20022 transformation

Don't settle for quick fixes when preparing for ISO 20022. Our solution offers a single native platform for all your payment rails, covering both domestic and international networks. You'll easily integrate value-added services and gain rich data insights to drive innovation. With our ISO 20022 solution, you're fully prepared for tomorrow's financial landscape.

Benefits you can bank on

Effortless compliance

Forget the scramble to meet new regulations. Our cloud-native SaaS solutions ensure you are up to speed with the latest ISO 20022 requirements for domestic and international payments, ensuring stress-free and on-time compliance.

Flexibile transformation

Centralize all payment rails or modernize based on business priorities. Tailor your bank’s transformation plans at the speed your business demands.

Accelerate readiness

Be ready to capture and leverage the expanded data fields of ISO 20022 for both back-office operations and digital experiences.

Glean valuable insights

Our advanced analytics leverage ISO 20022 data, empowering you and your customers to gather insights and make data-driven decisions.

Seamless integrations

Our platform integrates seamlessly with your core banking system and ancillary tools like AML and OFAC, ensuring quick deployment and a smooth transition.

Fed-certified Fedwire solution

Embrace ISO 20022 standards with our certified Fedwire solution, with transformation approaches tailored to your specific needs.

MX-ready for SWIFT transactions

Seamlessly transition to ISO 20022 messaging standards for SWIFT with our MX-ready platform, ensuring compliance ahead of migration deadlines.

Instant payments on ISO 20022 standards

Ensure seamless and efficient processing of instant payments with our ISO 20022-native platform for FedNow and RTP.

Universal message translation

Easily preprocess messages from any format and convert them to the ISO 20022 messaging standard.

ISO 20022 compliance made easy

The world is moving forward—don’t get left behind. ISO 20022 messaging are becoming the global norm. Makeshift solutions to meet migration deadlines increase costs and fall short of customer expectations. Deliver value-added services and take full advantage of the ISO 20022 opportunity with our future-proof solution.

Insights

Finzly Clients Ready for Fedwire’s ISO 20022 Shift

Fedwire’s ISO 20022 Migration: Why It Matters - and How Institutions are Gaining an Edge

Payment Modernization Strategies for Mid-Sized Banks: Preparing for 2025 and Beyond

Finzly’s Platform Ensures Customer Readiness for ISO 20022 Transition Ahead of Deadline

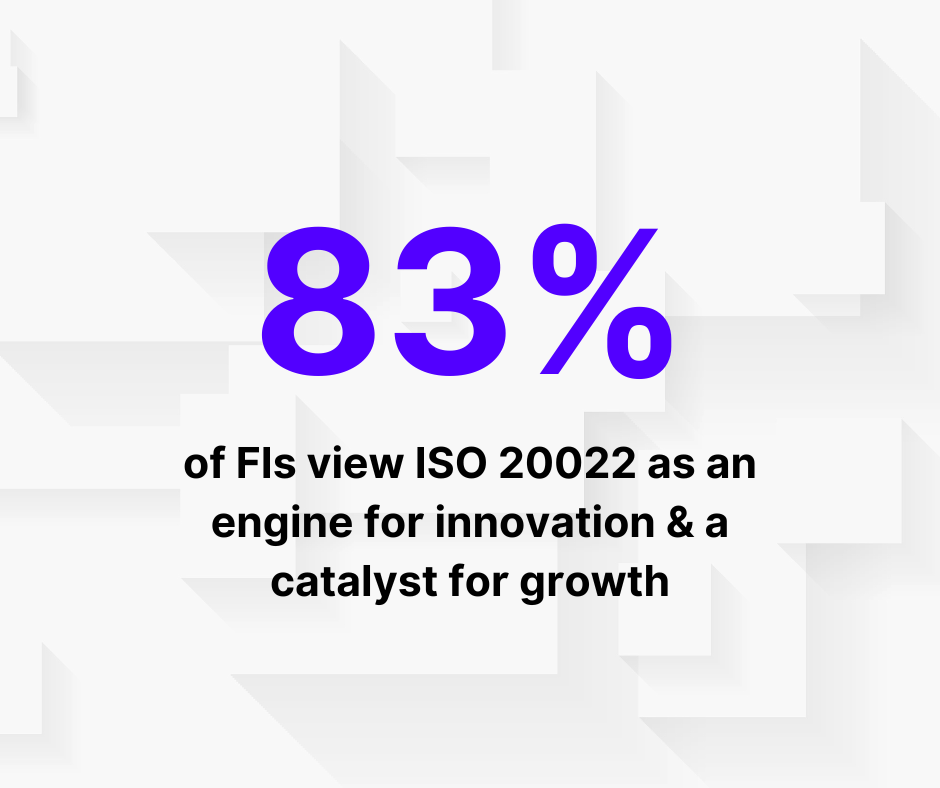

ISO 20022: The Untapped Opportunity for Financial Institutions

ISO 20022 Changes the Future of Financial Transactions

ISO 20022 for Fedwire: A Strategic Imperative for Financial Institutions

ISO 20022 as a catalyst for boosting SMB revenue