Business Banking that solves real world problems

Business banking just got a supersized upgrade

Tired of cookie-cutter banking solutions that miss the mark for SMBs and enterprises? Struggling to deliver tailored digital experiences for niche sectors like healthcare, real estate, and SaaS providers? Our platform offers customizable solutions to meet each industry's unique needs.

Engage your customers on their terms with seamless experiences designed for their readiness- whether it's APIs, ISO 20022 messages, or file processing. Plus, our rail-agnostic payment solutions empower your bank to stand out in a crowded marketplace and grow new business banking revenue.

Benefits you can bank on

Stay fintech-forward while focusing on growth

Offer smart banking solutions that evolve with the latest fintech trends, offering everything from seamless invoicing to advanced treasury tools. We keep you on trend while you focus on business growth.

Minimal effort through plug-and-play integrations

Want to expand your offerings without compromising your customers' familiar banking experience? Digital Galaxy seamlessly integrates with all major digital banking platforms, ensuring a smooth transition for your customers.

Instant payments, instant differentiation

Differentiate from competition with the only business banking experience in the US that allows businesses to send, request and receive instant payments on FedNow® and RTP®.

Simplified deposit management

Let customers effortlessly manage deposit accounts, beneficiaries, transactions, tax documents, statements, and specialty reporting in one place. And with support for MT940/950/ISO standards, it seamlessly integrates with accounting systems.

Rail-agnostic one-click payments

Offer your customers a rail-agnostic, one-click solution. They can send, receive, request payments across ACH, Fedwire, FedNow®, RTP®, and Swift, manage approvals, and initiate instant, domestic and international payments.

Streamlined B2B management

Schedule recurring payments with custom rules, request payments through debit requests, drawdowns and Request for Payment, audit payment history, validate international bank details, and manage travel rules – all from one experience.

Multi-currency accounts

Allow your customers to manage their multi-currency accounts to help them take control of their global operations. Real-time currency conversions, international transfers, notifications and comprehensive reporting for their ease.

Actionable dashboards

Give your customers complete visibility with dashboards that provide real‑time insights and customizable reporting to drive data‑driven decisions.

Omnichannel payment processing

Allow your customers to securely upload payment files via SFTP, open APIs for embedded banking, or, integrated channels, with bespoke support for custom requirements.

Enterprise-grade security and control

Provide your customers with robust security features like 2FA, biometric authentication, and self‑service password management and a powerful admin console lets them manage users, roles, and limits with ease.

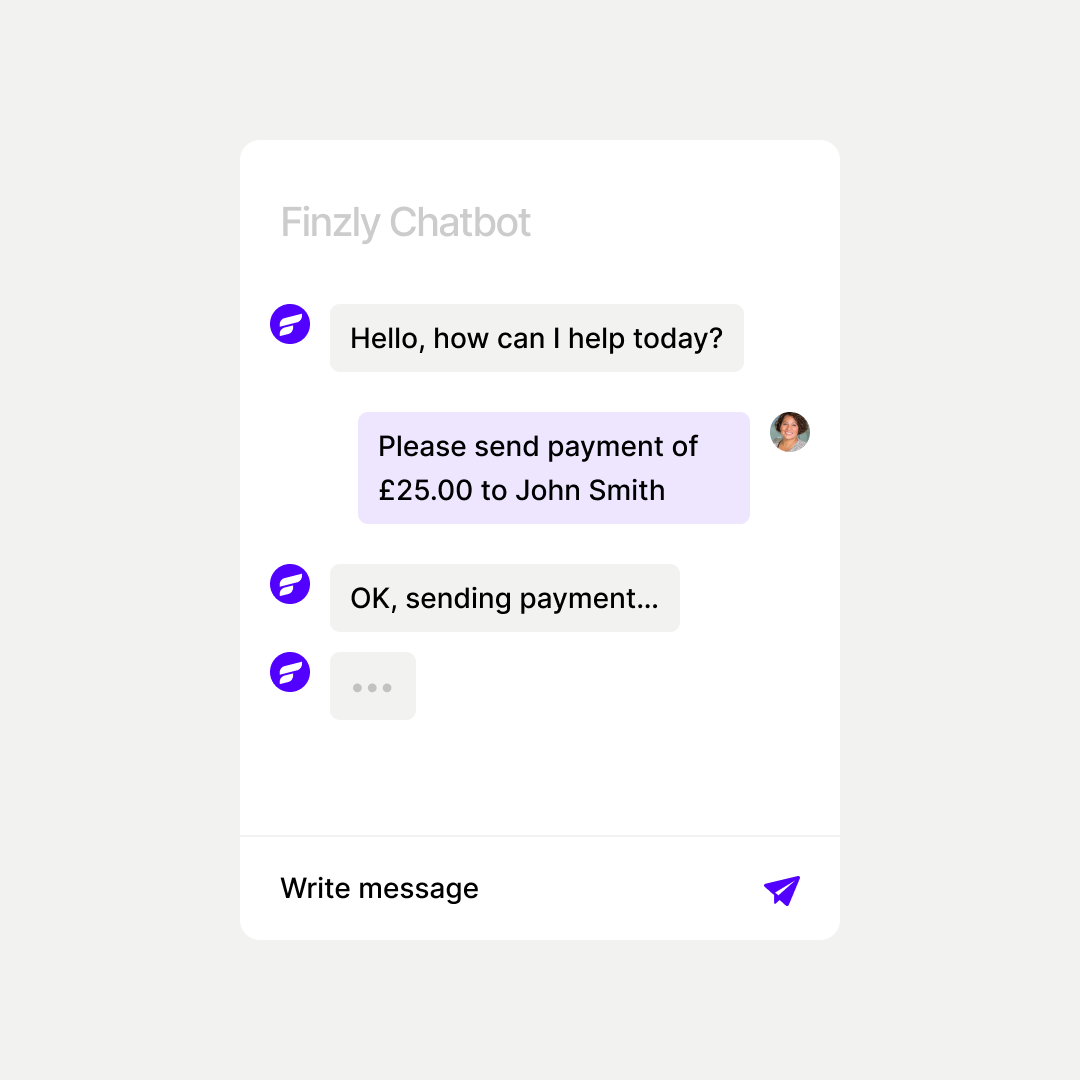

The chatbot for instant payments

Say hello to Finzly’s chatbot – a new feature to our business banking experience that transforms the way your customers manage payments. An interactive and helpful experience, it’s a whole new way of sending, requesting and receiving payments.

Insights

When Banks Merge, Payments Get Messy. Here’s How to Keep Them Moving.

Finzly Announces Integration With Q2's Digital Banking Platform

Finzly Announces its Stablecoin and Tokenized Deposits Strategy for Its API-First, Multi-Rail Payment Platform

American Banker Webinar On Demand: What Bankers Really Think About Stablecoins – And Why It Matters Now

FedNow® at Two: “Astounding” Growth with Plenty of Room to Grow