ISO 20022: The Untapped Opportunity for Financial Institutions

Banks need to prepare themselves for processing changes that can receive, store and process data in the structure and granularity prescribed by the global ISO 20022 compliance standard.

What is ISO 20022?

ISO 20022 is "a single standardization approach (methodology, process, repository) to be used by all financial standards initiatives."

The standard helps banks to include contextually relevant data, that can improve business processes and remove inefficiencies in payment systems. Banks are rolling up their sleeves to implement the new standard. Clearing houses and SWIFT are shifting gears to the new standard as early as 2022, with the current cross-border payments SWIFT MT messages planning to be decommissioned by 2025.

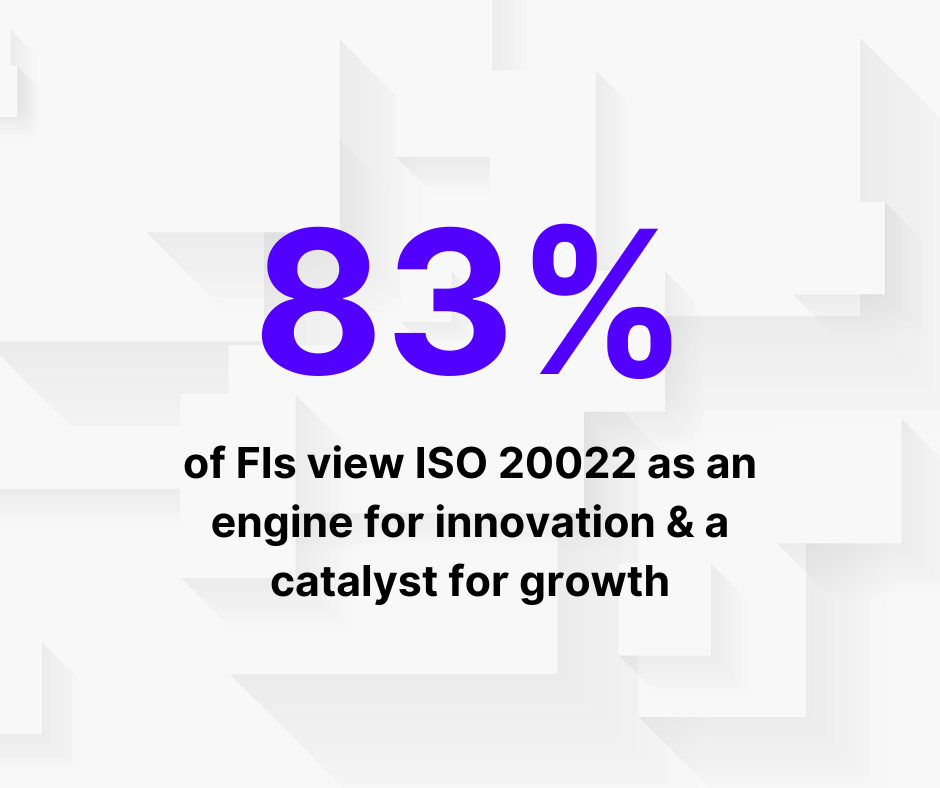

The million-dollar question is: Are banks seeing this as yet another compliance project?

The migration to ISO 20022 is much more than a compliance mandate for banks. Banks that see the value offered by the granularity of the structured and enriched data sets - whether it is streamlining remittances or leveraging the full power of instant payments to reconcile in real-time, are using it as an accelerator to unlock value-added services that the standards encompass.

Innovation through interoperability:

Process automation, leading to reduced friction in the payment lifecycle, improves customer experience. In order to bring about process automation and enable seamless building of innovative value-added services, standards are needed. With standards, not only is interoperability of multiple payment rails promoted, but the rich remittance data enables automatic reconciliation of funds. Through reusable common data components, structures can be built to define concepts that can eventually drive value to customers.

How will the new definitions affect payments?

For lack of a better language and common business terminology, proprietary legacy clearing standards have failed to include contextually relevant data to payments. ISO 20022 definitions will reduce ambiguity when exchanging financial information associated with payments. With clear stability in definition and roles, more transparency is built into payments.

Why is wire converting to ISO 20022 while ACH is not?

Cross border ACH is a very small percentage of all ACH payments. However, there is a higher percentage of cross-border traditional bank-to-bank wire payments. With pressure from other countries' wire systems or RTGS systems converting to ISO currently, wires are converting to ISO as the priority.

A sea of change in cross-border payments:

With the richness of data, payment flows can be routed in the most appropriate cross-border payment rail, making cross-border payments quicker, cheaper and more transparent. With global markets and international networks already enjoying the fruit of ISO 20022 adoption, there is considerable pressure in the US. SWIFT network is migrating both cross-border and cash management messages while the European market has already implemented ISO 20022 through its SEPA networks.

Payment modernization considerations

ISO 20022 support is a major consideration when banks embark on payment modernization. Finzly's payment hub supports ISO 20022 compliance for all the payment rails it supports including SWIFT, RTP®, FedNow® and wires. This way banks can ensure that there is:

These standards not only empower customers with more choice and convenience but also make payments more transparent in an itemized and categorized way, making more sense to the end customer.