When Banks Merge, Payments Get Messy. Here’s How to Keep Them Moving.

The SVB crisis has resurfaced discussions about the readiness of banks to prevent wire frauds. Every manual touchpoint in the processing of wires introduces an element of risk of fraud, prompting financial institutions to seek more efficient ways to automate wire processing through modern end-to-end capable systems.

There's been a notable surge in both value and volume on the Fedwire network, with March 2023 seeing a monthly growth of over 25% in volume and 27.3% in value. However, where fraud mitigation is not in place at banks, wire transfers remain a significant avenue for money laundering, creating economic vulnerabilities for banks. As a result, banks are dedicating more transformation initiatives towards modernizing their wire systems to eliminate unnecessary manual touchpoints and increase automation, thereby improving straight-through processing (STP) rates and minimizing the risk of fraud. Nevertheless, there are certain features in the Fedwire processing system that can effectively mitigate these risks.

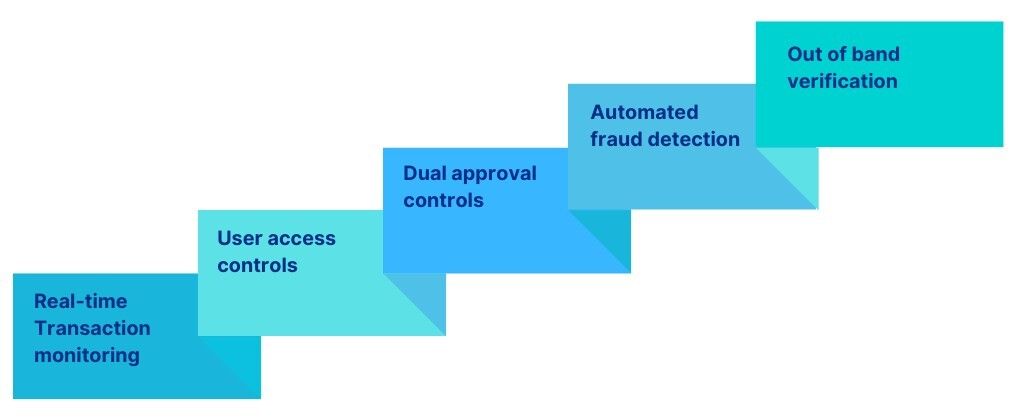

Some of these features include:

As wire fraud becomes an increasingly complex issue for financial institutions, it is imperative to adopt modern solutions that can effectively combat these threats. Finzly's built-in capabilities and their integrations to cutting-edge fraud management systems enable banks to stay ahead of the curve and keep fraudulent wire transfers at bay.

The sunset of the existing proprietary Fedwire Application Interface Manual (FAIM) format messages and the corresponding replacement with equivalent ISO 20022 message format will take place in a single-day implementation strategy on March 10, 2025. In addition to improving the processing capabilities of wire transfers, the new enriched format is also expected to help banks and other organizations in meeting their obligations related to anti-money laundering measures and sanctions. As banks explore modernizing their Fedwire solutions in anticipation of ISO 20022 migration, it is imperative to consider these criteria when evaluating options. By ensuring that their Fedwire systems have these key features, banks can more effectively control fraud and reduce the risk of fraudulent transfers.