When Banks Merge, Payments Get Messy. Here’s How to Keep Them Moving.

In an age of hyper-personalization, the success of financial institutions (FIs) in FX hinges on their capacity to provide specialized services that cater to the unique international banking needs of their diverse clientele.

Companies, from Etsy shops to export giants, increasingly do business with international customers and suppliers. A recent Finzly poll reveals 93% of financial institutions grew cross-border payments in the last two years. FIs are ideally positioned to capitalize on this trend by offering competitive FX services to a diverse clientele. But who exactly are the customers they should be targeting, and how can financial institutions best serve them?

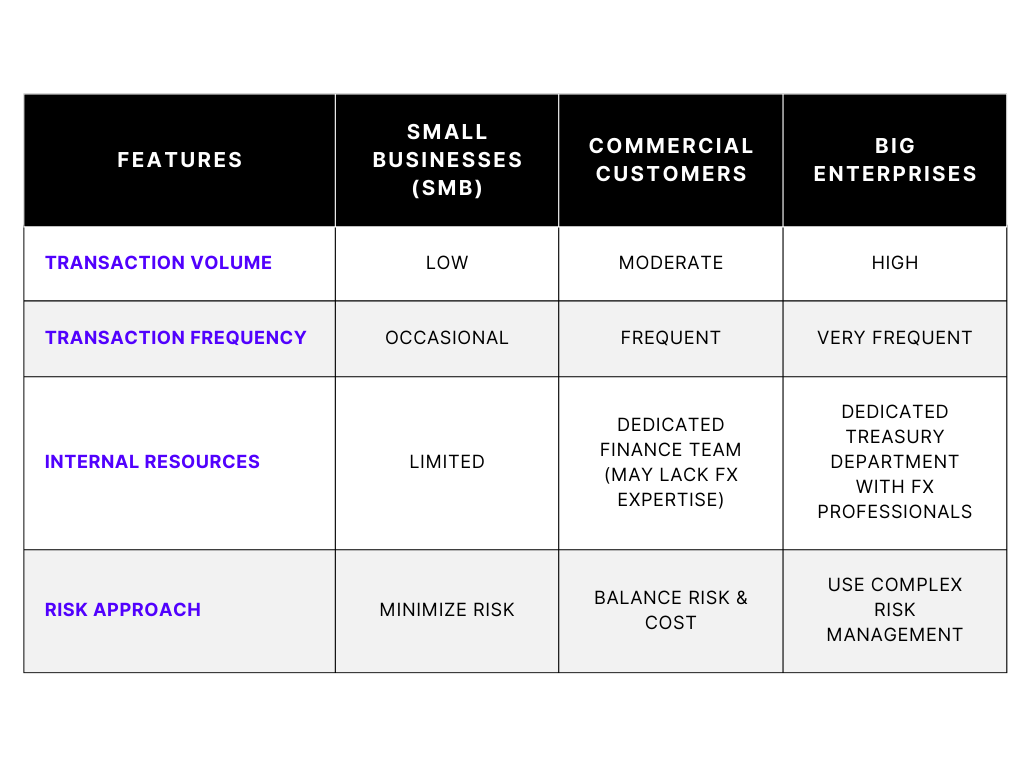

Financial institutions operate across various sectors within the FX market, serving small businesses, commercial clients, and large enterprises. Each sector has unique needs, requiring tailored FX solutions to effectively manage currency fluctuations. Hence, financial institutions must adapt their services to cater specifically to the requirements of each customer segment.

We are servicing customers ranging from the mom-and-pop business to the consumer walking into the branch all the way up to the middle market large corporates.

Small businesses are strapped for staff and lacking international banking expertise. They simply don't have the time or resources to navigate the complexities of foreign currencies. Financial institutions wanting to appeal to them should offer the following:

International Payments. SMBs expect user-friendly online banking platforms offering competitive exchange rates and low transaction fees for occasional foreign exchange payments. Additionally, they look for integration with popular accounting software to streamline processing and enhance efficiency.

Piecing it all together from the convenience of their accounting platforms is very crucial.

Multi-Currency Accounts (MCAs). SMBs require multi-currency accounts (MCAs) to manage various currencies received from international sales effectively, facilitating easier conversion as required. Most SMBs lack the transaction volume to justify maintaining separate accounts for each currency. Bundled options with competitive exchange rates for conversions can provide significant value.

“Small businesses that offer professional services in the technology sector especially need multicurrency capabilities and offering that has been a gamechanger for us”, says a Senior Director, Foreign Exchange, of a $70B regional bank.

Limited FX Exposure Management. Financial institutions can offer educational resources and basic hedging tools like forward contracts for smaller transactions. Some financial institutions also run webinars on managing currency risk, empowering SMBs to navigate international trade with confidence.

As businesses scale, the complexities of international trade grow. They become commercial customers, managing frequent transactions and currency risk. They demand:

Dedicated FX Trading Platforms. Financial institutions should offer intuitive platforms equipped with tools for handling frequent transactions, real-time market monitoring, and seamless order placement.

We offer our more sophisticated customers to actually do trading on the platform, and our customers who just want to make a payment to log into the platform and send out a wire transfer.

Expanded Hedging Options. Commercial customers expect a wider range of hedging products beyond forward contracts, including options and swaps, allowing for more sophisticated risk management strategies tailored to their specific needs.

Trade Finance Solutions. Financial institutions can facilitate international trade by providing financing for imports and exports. Commercial customers who may not have the working capital to finance large overseas transactions are good prospects.

Relationship Management. Financial institutions offer dedicated relationship managers with FX expertise to understand their business and recommend customized solutions.

For example, Fulton Bank provides tailored solutions for sectors including healthcare, life sciences, agriculture, dealerships, and professional services. Fulton Bank then meets every client's distinctive requirements with expert care.

Enterprise customers are global players navigating the currency landscape with a team of financial experts. They require the most advanced FX solutions to manage significant currency exposure including:

Direct Market Access. Financial institutions can offer real-time access to execute large FX trades directly in the market through self-service portals, allowing for greater control and potentially better execution prices.

Advanced Hedging Strategies. Advanced hedging strategies, using options, swaps, and derivatives, effectively mitigate currency exposure for enterprises. Companies like General Electric (GE), with extensive international operations, benefit significantly from tailored hedging strategies to manage currency risks across their global supply chains and sales.

Treasury Management Services. Offer a comprehensive suite of services for global cash management, including concentration accounts, international receivables and payables management, and risk mitigation tools. For example, a global enterprise with a vast network of international subsidiaries and operations needs to ensure optimal liquidity and risk management across various currencies.

Trade Finance Solutions. Facilitate large-scale international trade financing with customized solutions tailored to their specific supply chain and risk profile.

The key to success lies in understanding that a one-size-fits-all approach simply won't work. Financial institutions need to adapt their services to suit the specific needs of each customer segment.

If we don't look at the whole picture from the specific customer’s perspective, I think we’re losing an opportunity.

International money transfers and online travel are not traditionally a core market for financial institutions in the FX space. Yet the growth in both present interesting opportunities. Consider:

Competitive Rates and Zero-Fee Transfers. Cater to budget-conscious travelers and those sending money abroad.

User-Friendly Mobile Apps. Offer convenient currency exchange on the go.

Partnership with Travel Agencies. Integrate FX services into travel booking platforms

Branch Services for International Payments. Offer the easy facility to initiate FX payments from branches.

Financial institutions must navigate the complexities of international trade and currency management effectively. They can adapt by providing intuitive platforms, diverse hedging options, and personalized relationship management. By doing so, they meet the diverse needs of their clientele and also position themselves as indispensable partners in the global marketplace, driving growth and resilience across industries.

Stay tuned for more information about our webinar with American Banker, titled "Growth strategies in foreign exchange: Synovus, First Citizens share their experience."

Learn more about Finzly's FX solutions here.