When Banks Merge, Payments Get Messy. Here’s How to Keep Them Moving.

This year has seen an intense surge in Bank-Fintech acquisitions. With digital banking becoming synonymous with fintechs, banks are creating new avatars, vaulting into the new digital ecosystem, either acquiring or being acquired by fintechs.

As Chris Skinner points out: No bank will be bankrupted by FinTech, but many banks will be assimilated by FinTech.

Earlier in November, the consumer lender fintech Opportun acquired neobank, Digit. The acquisition is a symbiotic fit for both, marrying mobile banking, automated savings and robo-investing and lending to customers of both Digit and Opportun.

The creation of BMTX Bank, a "fintech-based bank" that combines BM Technologies and First Sound Bank to steer towards a profitable, technology focused business model using a proprietary BaaS platform is another similar tech-driven acquisition.

US Bank's acquisition of the platform TravelBank, and Keycorp buying a payments fintech partner are other sides of the acquisition coin, led by banks.

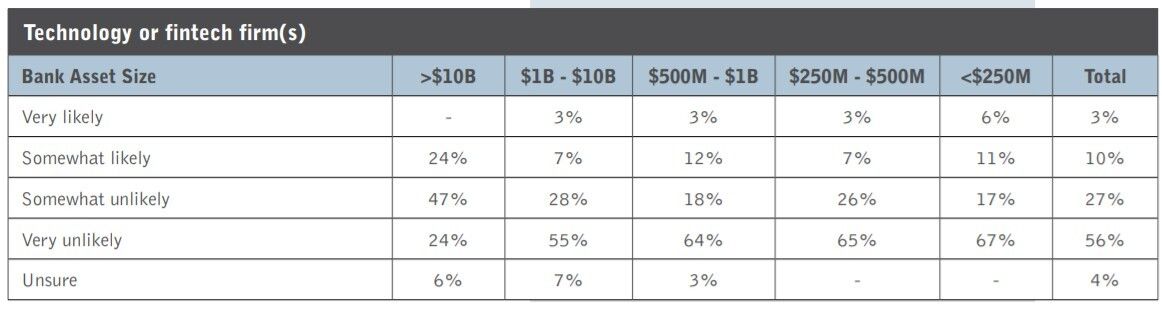

Well, the story also pervades to banks eyeing each other for strategic mergers. A whopping 180 mergers have happened in the run up to Q3 this year. There's an increased merger of equals, creating combined size and scale for banks. Bank Director's 2022 M&A survey reveals that smaller banks are also ready to grab the opportunity of acquiring technology/fintech firms.

It's not just about fintechs...

While the immediate priority for many banks is partnering with fintechs with blurring lines between the institutions in the new ecosystem, banks are also turning to non-financial providers. For instance, going beyond fintechs partners in wealth management, insurance and lending, banks are pleasing the banking needs of edtech, healthtech, agritech, to name a few. This is especially common in community banks that are focused in serving niche customers using specialized services.

It looks like banks are tired playing catch up on providing APIs to fintech partners. This can be morbid with more probability of failure, with legacy system APIs unsuitable for fintechs.

Using a parallel digital core that offers FBO/virtual accounts, Finzly can facilitate bank-fintech partnerships in less than a week. Whether it is opening up a real-time ledger or offering Payments as a Service, onboarding fintechs on a digital core has high success rates. Find out more.