When Banks Merge, Payments Get Messy. Here’s How to Keep Them Moving.

Recently, the CFPB has released key guidelines that are changing how banks and fintechs work together. These rules are more than just about following regulations. They're setting the stage for open banking and fair competition in a growing digital financial world.

For traditional banks to succeed in this new landscape, it's crucial to understand and adapt to these six key CFPB guidelines.

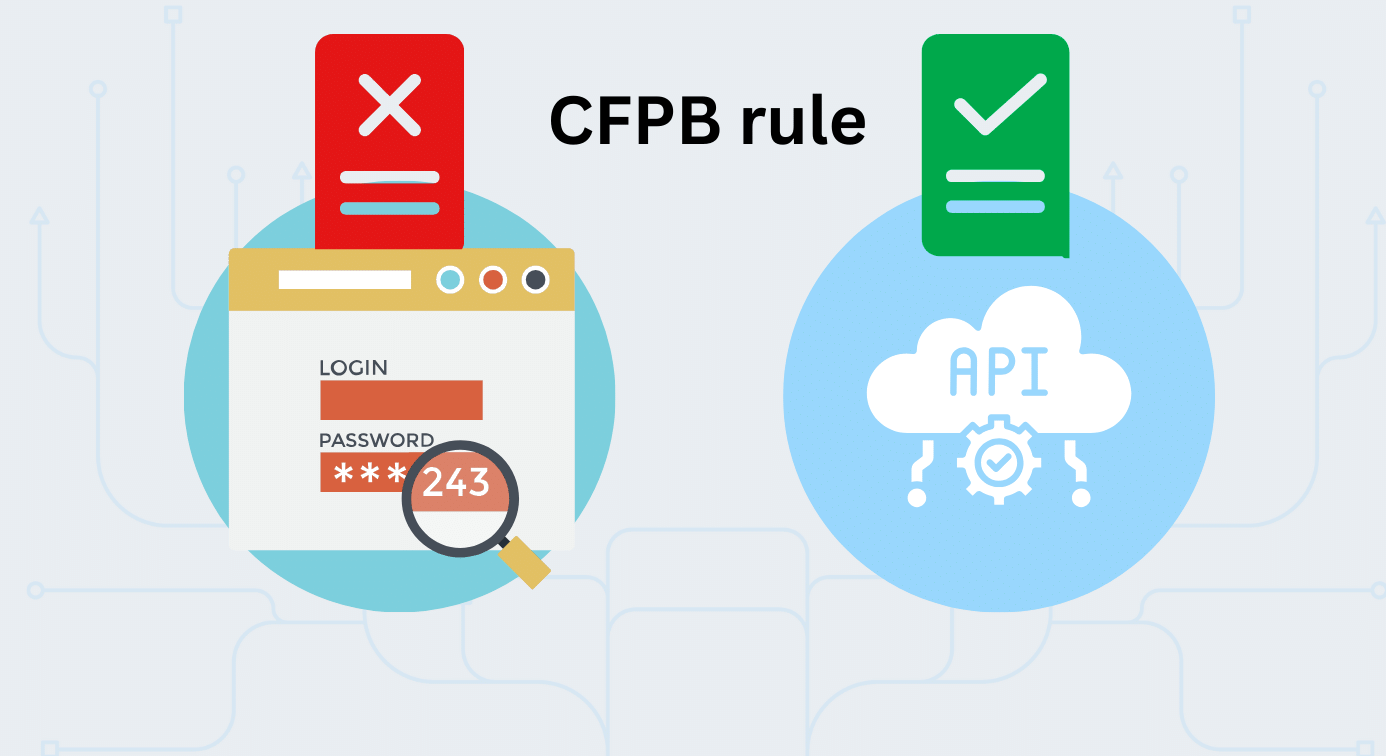

With the rise of alternative financial products and services offered by fintechs, CFPB requires financial institutions to share customer financial data with other service providers. This shift fosters competition and offers FIs the chance to improve their infrastructure.

In preparation, banks are moving towards Application Programming Interface(API)-first financial technology solutions to securely share account, transaction, and other data. They can also open new revenue streams from these data-sharing opportunities while offering secure, user-friendly interfaces. Learn more about the 1033 Rule here.

Implementation of the 1033 rule follows a "big fish first" approach. Larger banks face tighter deadlines, while smaller institutions get more time to adapt. The compliance clock starts ticking in fall 2024, with deadlines staggered over four years based on asset size. Make sure you know where your institution falls in this timeline and plan accordingly.

The CFPB is emphasizing transparency in accounting to maintain consumer trust and meet regulatory expectations. But why?

With the growth of Banking as a Service (BaaS), banks face more complicated accounting needs because they now manage transactions for their customers' clients. Previously, banks relied on BaaS solutions for this accounting. But recent accounting issues with these platforms have shown that banks need strong in-house ledgering capabilities. Virtual accounts and modern virtual ledgers can handle the complexities of BaaS, giving banks better control and insight, especially in fintech partnerships and embedded finance.

As data exchange between financial ecosystem players increases, standardization is crucial. The CFPB now recognizes technical standards developed by standard-setting organizations. Ensure your APIs and vendor engagements comply with these standards for better ecosystem adoption and easier integration.

American consumers face liquidity challenges with their biweekly pay cycles. They are increasingly turning to “earned wage access” or “earned wage advance” products to manage the financial challenges. The CFPB has recognized two main types of these products: employer-partnered and direct-to-consumer.

In the employer-partnered model, repayments are deducted directly from payroll. However, these loans often carry annual percentage rates (APRs) over 100%. Direct-to-consumer models, on the other hand, use automated withdrawals from the employee’s bank account, which can lead to debt issues. Additionally, 73% of employees engage in tipping activity for extending the credit.

The new CFPB rule requires lenders to clearly disclose the costs and fees associated with these products. Banks partnering with payroll platforms and fintech companies that offer such loans need to be aware of these regulations and their implications.

Some financial institutions are offering these services directly, leveraging instant payment capabilities through FedNow® or RTP® networks as a compliant alternative to address workers' liquidity needs. This could help address the cashflow issues associated with biweekly pay cycles and offer a competitive advantage.

Buy Now, Pay Later products (BNPL) are under increased scrutiny. New CFPB guidelines will require BNPL lenders to handle disputes, issue refunds for returns, and provide regular billing statements.

Banks working with BNPL fintechs must make sure they follow these new rules. This requires thorough due diligence and possible revisions to risk assessment strategies and contractual agreements with fintech partners engaged in BNPL.

Staying ahead of these CFPB guidelines is crucial for banks aiming to thrive in the modern financial ecosystem. By preparing for open banking, banks can successfully manage fintech partnerships and improve their financial services by ensuring clear accounting, knowing compliance deadlines, and following consumer protection rules.

Partner with Finzly to gain a strategic edge in regulatory compliance and open banking readiness through our API-first solution for payments and accounts. By bringing BaaS operations in-house for accounting and payments, you’ll cut unnecessary costs and gain better control over your fintech transactions.